The Power of Acceleration and Prevention in the Recovery Audit Process

Typically, a recovery audit is used to ensure payment accuracy and eliminate financial leakage; oftentimes discovering errors and having to correct them. However, what most businesses do not realize is that traditional post-audits can fall short and unknowingly leave money on the table.

But when leveraged correctly, recovery audits are just the first step in a larger process of elevating your operational efficiency.

Recovery audit firms often tout how they help people get from reactive to proactive... But what does that really mean? What would that look like?

The issues getting in the way of companies creating proactive solutions stem from firms' stagnant processes that stop at diagnosis and do not implement tools or procedures to help avert financial loss before it happens.

People in the industry talk about how recovery auditing can also serve as a way to uncover areas of opportunity through “root cause analysis.” Recovery auditing firms say they can provide actionable insights that improve financial processes... but they often fall short in helping companies prevent errors and financial leakage from happening in the first place.

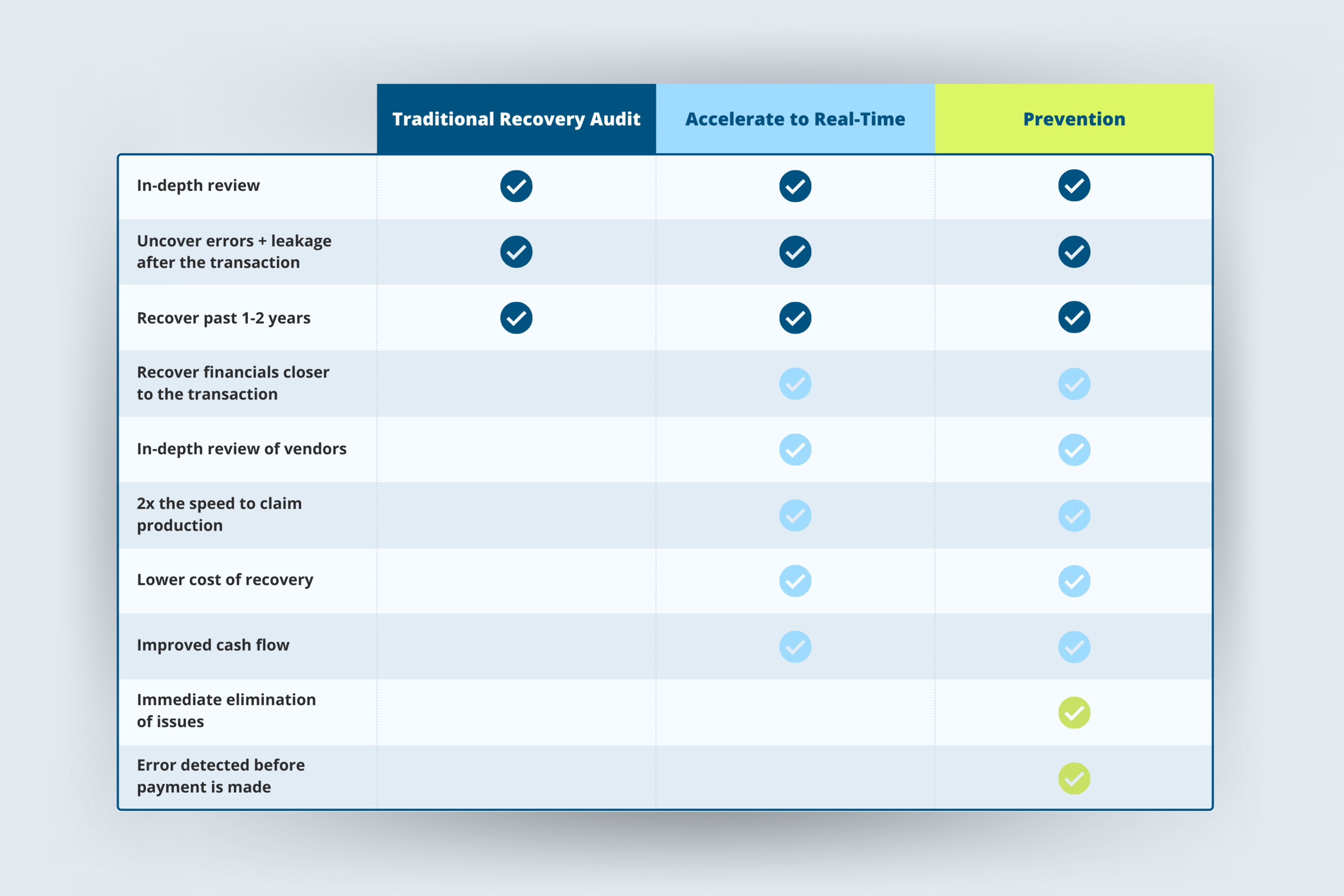

Post-audit recovery may be the start of the process, but clients are increasingly expecting more. The future of recovery auditing lies in accelerating the review, getting as close to the transaction as possible, and ultimately leading to error and leakage prevention.

Key Takeaway

Post-audit recovery may be the start of the process... but clients are increasingly expecting more. The future of recovery auditing lies in accelerating the review, getting as close to the transaction as possible, and ultimately, driving toward error prevention.What does acceleration mean in the context of a recovery audit?

Acceleration is an approach to recovery auditing in which businesses choose to bring the review process closer to the point of transaction.

What this means → Instead of waiting one or two fiscal years after the transactions have occurred, they might be reviewed one or two quarters after they have occurred.

Note: There are different ways to approach an accelerated recovery audit. A business may choose to audit by claim type, split the audit by time (all vendors reviewed in a set time period), or split by vendor (vendors reviewed during their specified settlement time period).

Why it’s beneficial to businesses → Settlements become easier because the data is more readily available as the buyers are typically still in their role and have not closed their books yet. This helps to avoid any confusion or negligence allowing you to resolve the issue immediately versus having to backtrack and recover information from years ago.

The Benefits of Accelerating Recovery Audit Activity Closer to the Transaction

The goal of acceleration is to:

create greater value,

improve supplier relationships, and

make process improvements more easily.

This can be achieved through a straightforward shift of the recovery audit schedule closer to when the transactions actually happen or even to real-time. Whether the review happens quarterly or semi-annually, acceleration’s purpose is to put money back into the business faster by reviewing financials faster.

Accelerated recovery audits can improve vendor relationships.

Accelerated recovery audits make the lives of your vendors easier… because when the vendor only has to look back ~one month for information versus digging up information from two years ago, they’re much more likely to enjoy working with your company.

Accelerated recovery audits capture more profit than a traditional recovery audit.

In addition to improved vendor relationships, time-restricted vendors can now be reviewed within the contractual timeline, increasing your likelihood of actually being able to recover the financial leakage. With accelerated recovery audits having twice the speed to claim production, companies see a much higher claim acceptance rate and far fewer paybacks. It also enables you to better mitigate financial discrepancies and margin loss.

Accelerated recovery audits empower operational efficiency.

When you double the speed to claim production, you’re enabling better alignment between trading, finance, and vendors. Identifying errors closer to the transaction essentially acts as a rapid feedback mechanism that empowers you to improve your processes and tools and evaluate the success or failure of those improvements in real-time.

What does Acceleration of a Recovery Audit look like?

With an accelerated audit schedule, there are a few ways you can move up the review process, which in turn recover financial leakage much faster than you would with a traditional post-audit.

1. Accelerate the External Primary and Secondary Audit Review

Many businesses complete the fiscal year in December or January followed by a few months to close out their books. This time period can take up to 7-8 months after the fiscal year closes. Meaning, it could take until July or August for the primary external firm to begin its review of the transactions.

When you accelerate this process, you are simply moving the start time of the primary external firm from July or August to right after the fiscal year closes around February. Because the audit activity is moved closer to the transaction by 6 months, this increases the chances for the primary external audit firm to uncover errors and successfully resolve claims at a much faster rate.

Once the primary external audit firm completes all its work, it can immediately hand off the review to the secondary audit firm. By establishing this rolling handover schedule from the primary to the secondary, the retailer accelerates the secondary review and increases the speed of potential secondary recoveries significantly.

2. Accelerate the External Review to In-Year

If your business does not have an internal recovery audit team, firms like FlexTecs can conduct in-year audits -- one quarter behind the transaction on a rolling basis -- for you.

Because this happens internally, meaning before handing the audit off to the primary external audit team, your organization does not have to make any changes to your external firms, therefore an in-year review provides the maximum benefit of acceleration.

3. Internal Recovery Support

Even if you’re not ready to invest in an entire team, you can instead invest in an audit technology platform (ATP), which can enable your team to audit internally. These tools are custom-fit to your unique environment and help you make sense of your transactional data, bridge operational gaps and streamline the claim production process.

For example, there are tools on the market that enable you to:

Contextualize your transactional data - Having data is one thing, but understanding what it means is an entirely different story. Having a tool that pulls your disparate data sources into a single pane of glass is one way to accelerate your recoveries and drive toward prevention. FlexTecs built FlexTools to do just that.

Capture more information that will aid in recoveries - The number one communication medium companies and vendors use is email. Having a tool that can search through thousands and thousands of emails, pulling out key information that aids in the claim process can be a critical element of acceleration.

Keep track of the status of your claims - Half the battle of making recoveries is keeping track of all of the moving pieces. Having a tool that empowers internal and external audit teams to manage documentation and track audit claims, while facilitating collaboration with vendors via a vendor portal can be extremely useful.

Because an accelerated review of transactions captures payment errors more quickly, it can help businesses become more efficient by uncovering opportunities to prevent financial leakage.

The best way to maximize your bottom line is to prevent financial errors from happening in the first place. And obviously, that’s easier said than done…

What is Prevention? What does Prevention look like?

When companies talk about prevention, they always talk about the idea of prevention.

While most recovery audit firms claim to help their clients get to a more preventative state, the fact that most of those same firms charge on a contingency basis makes that claim hard to believe. Why would they tell you how to prevent the errors if those errors make their business’ very existence possible?

As a result, the idea of prevention is frequently talked about but rarely realized.

When we discuss prevention, we discuss our two methods that help build prevention programs within businesses:

Immediately eliminate the issue and not allow the claim to occur in the first place.

For example, we’ve incorporated custom-built technology that addresses operational errors found in root cause analysis and then uses that insight to identify and stop duplicate payments before they even get out the door.

When a mistake has happened, we catch the error within payment terms (i.e. net 30).

How can you adopt a more preventative posture?

Post-audit recovery → Audit a cycle of transactions

Accelerate the audit to real-time → Bring the review process closer to the point of transaction in order to bring claims up to date

Prevent errors + leakage → Incorporate or build tools that integrate with your current tech environment to fill the gaps

Incorporating acceleration and preventative measures don’t necessarily mean you abandon other recovery audit functions. Post-audit recovery is still necessary because some claims have to be made post-transaction. However, the majority of claims can be accelerated and/or prevented.

By incorporating preventative measures, you create more efficiency within your operations. You are still conducting post-audit recoveries but by allowing acceleration and prevention, you are enhancing your financial operations.